Background

A value chain analysis for tidal stream, wave and floating wind energy has been conducted by BVGassociates in 2019 within the OPIN project. The geographical scope of the study covered the following North-West Europe countries: Belgium, France, Germany, Ireland, the Nertherlands and United Kingdom.

This study involved a thorough, desk-based, research task and literature review, with the main aim of identifying the main Small and Medium-sized Enterprises (SMEs) and other organisations in the value chain of these three technologies. Organisations were categorised according to value chain area to inform the OPIN partners on suitable actors, technologies and thematic areas to engage with.

A summary report and a presentation are available for download at the bottom of this page. The full report is available exclusively to OPIN members on request.

Purpose of the study

- To give OPIN partners a picture of the current size and composition of the value chain, covering the full project lifecycle:

- Development and project management

- Device supply

- Balance of plant (inc. transmission)

- Installation and commissioning

- Operations, maintenance and service (OMS)

- Decommissioning

- To point out gaps and opportunities in the current value chain, within the OPIN regions

- Identify the key sectors for the OPIN network to engage with.

- Provide general information and contact details for the different clusters and organisations that OPIN could engage with.

Methodology

The study was a desk-based, research task and literature review.

The following topics were examined for the three technologies and the six areas of the value chain (from development to decommissioning):

- What are representative costs for an early stage commercial system?

- Who are the key companies and organisations involved?

- What is the maturity of the technology and supply chain?

- What is the capability in each OPIN partner country?

Based on the above, conclusions and recommendations were formulated for OPIN:

- High level recommendations based on renewable technology and partner country.

- Technology recommendations, giving BVGA’s opinion on where OPIN could best create value in the value chain.

5 recommendations where OPIN could add good value

- Project development: low cost element but crucial to get devices in the water and minimising LCOE

- Software solutions for logistics/O&M: could help standardise modelling approach across industries and provide third party verification

- Manufacturing: cost savings can be achieved thanks to large manufacturing techniques, common systems (dynamic cables, foundations, mooring systems) between the three technologies and closer collaboration between device suppliers and manufacturing facilities

- LCOE analysis and data sharing: ensure consistent LCOE analysis between different technologies and understand current modelling concerns and limitations. Data sharing would be beneficial to improve model accuracy and ultimately reduce LCOE.

- Use existing structures: Joint Industry Projects are already encouraged by existing structures (Carbon Trust Offshore Wind Accelerator, Wave Energy Scotland, ADEME, etc.), which OPIN could feed into or support financially

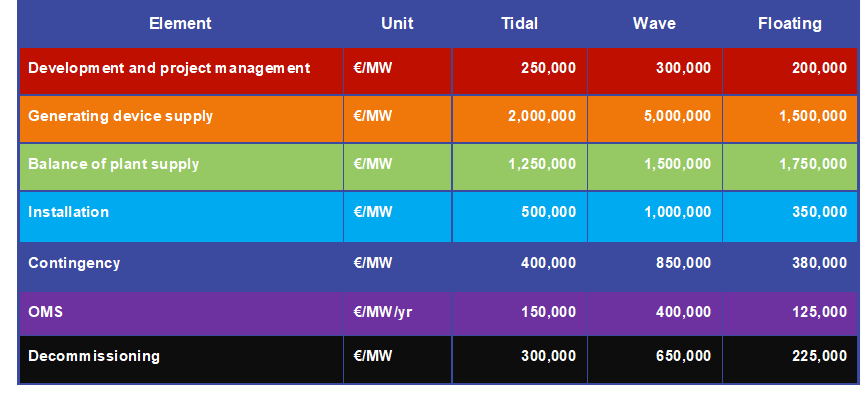

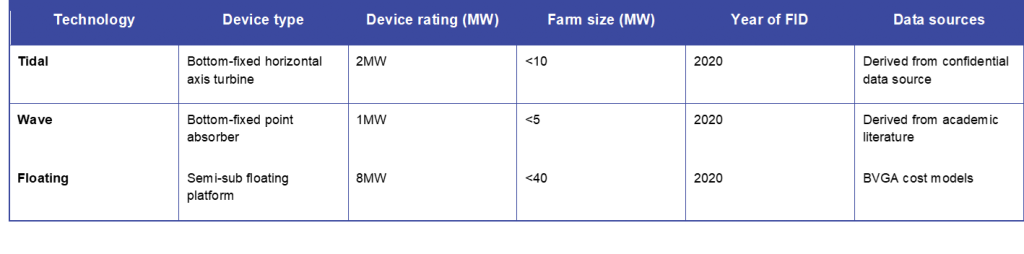

Typical costs for tidal, wave and floating wind

The study also provides typical cost breakdown for early stage commercial tidal, wave and floating wind farms, considering projects commissioned in 2020. The numbers are indicative and rounded, and are purely to give an appreciation of where the most significant project costs might be expected in the value chain for a Northern European project. In reality these will vary greatly depending on the technology and suppliers used, local site conditions and jurisdiction (among other aspects).

Source: BVGA Value Chain study 2019 – OPIN project

Key companies and organisations involved in the value chain

The full report includes an identification of key companies and organisations involved in the various parts of the value chain (from development to decommissioning) and highlighting areas where cross-collaboration would be more beneficial.

Tables are available for the three technologies (tidal, wave, floating wind) and country by country in the full report.

The full report is available exclusively to OPIN members on request.