Background

The Offshore wind in Europe – key trends and statistics 2020 report is compiled by WindEurope using data gathered from the offshore wind industry. The report provides an in-depth analysis of new offshore projects deployed at sea in 2020, together with an outlook for 2030. The statistics provided cover the annual and cumulative capacity for fixed and floating offshore wind in Europe.

The full report is available to download here and at the bottom of this page.

Key figures for 2020

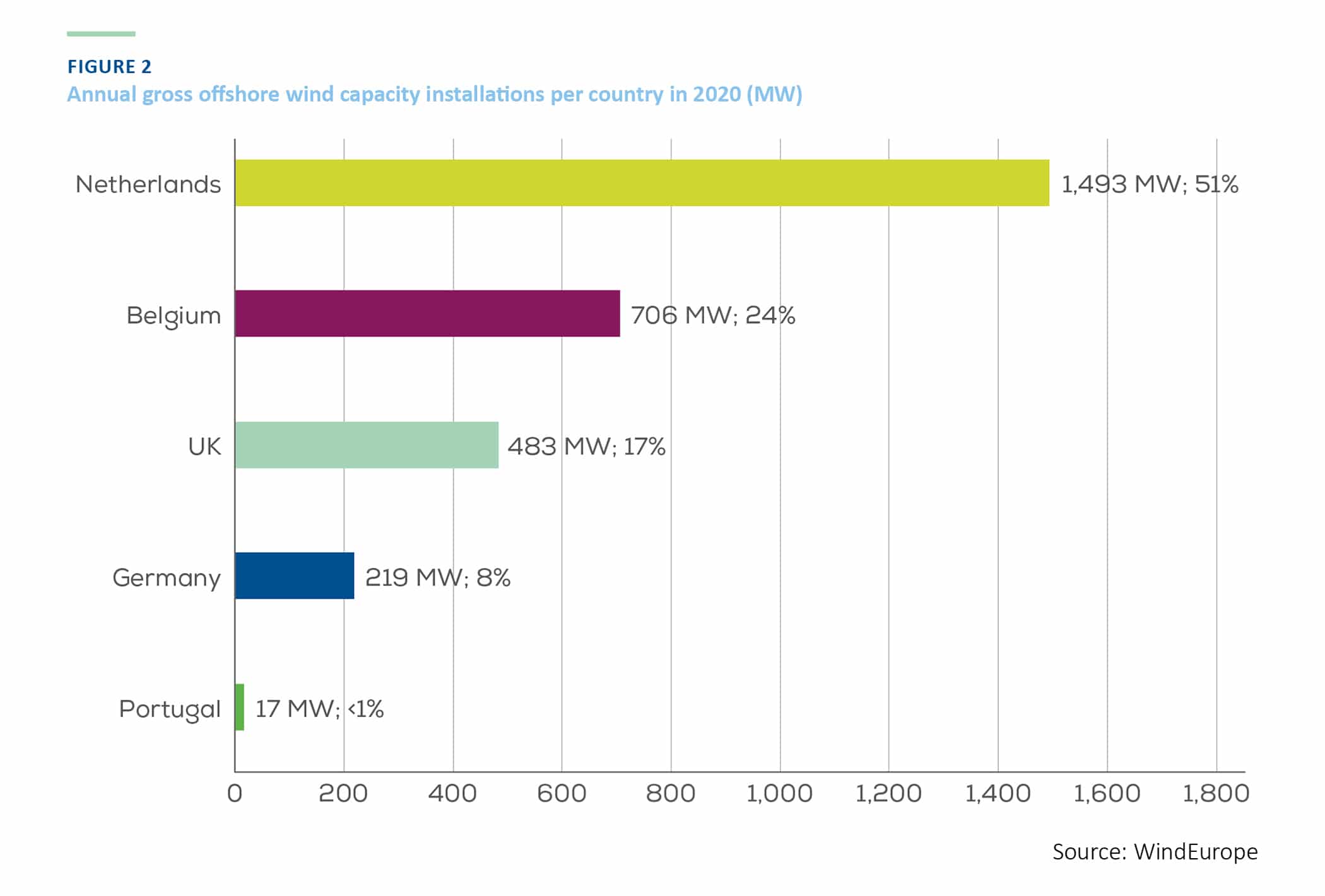

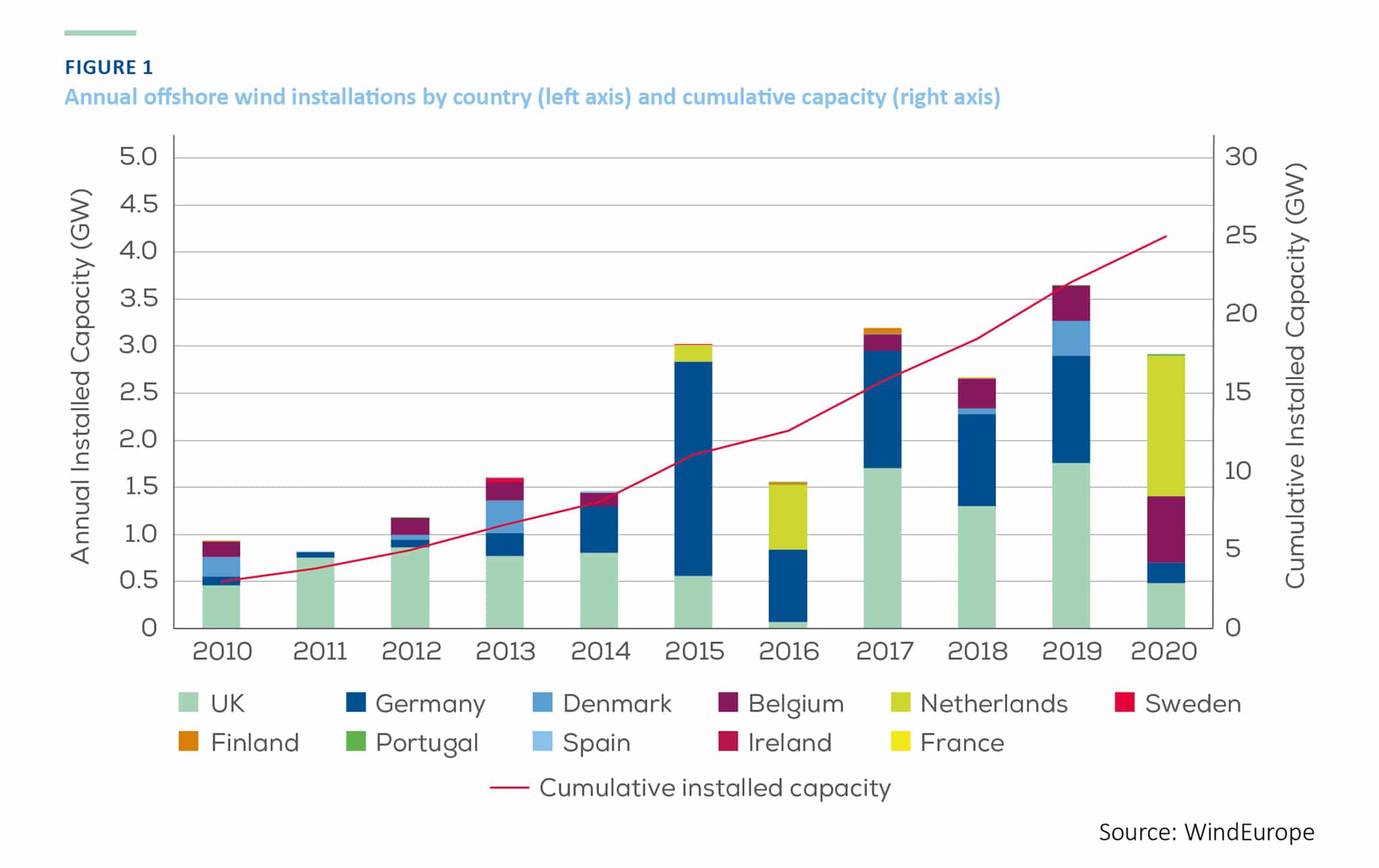

- Europe added 2.9 GW of offshore capacity in 2020. This represents 356 new offshore wind turbines connected to the grid, spread over nine wind farms.

- Europe now has a total installed offshore wind capacity of 25 GW. This corresponds to 5,402 wind turbines connected to the grid in 12 countries.

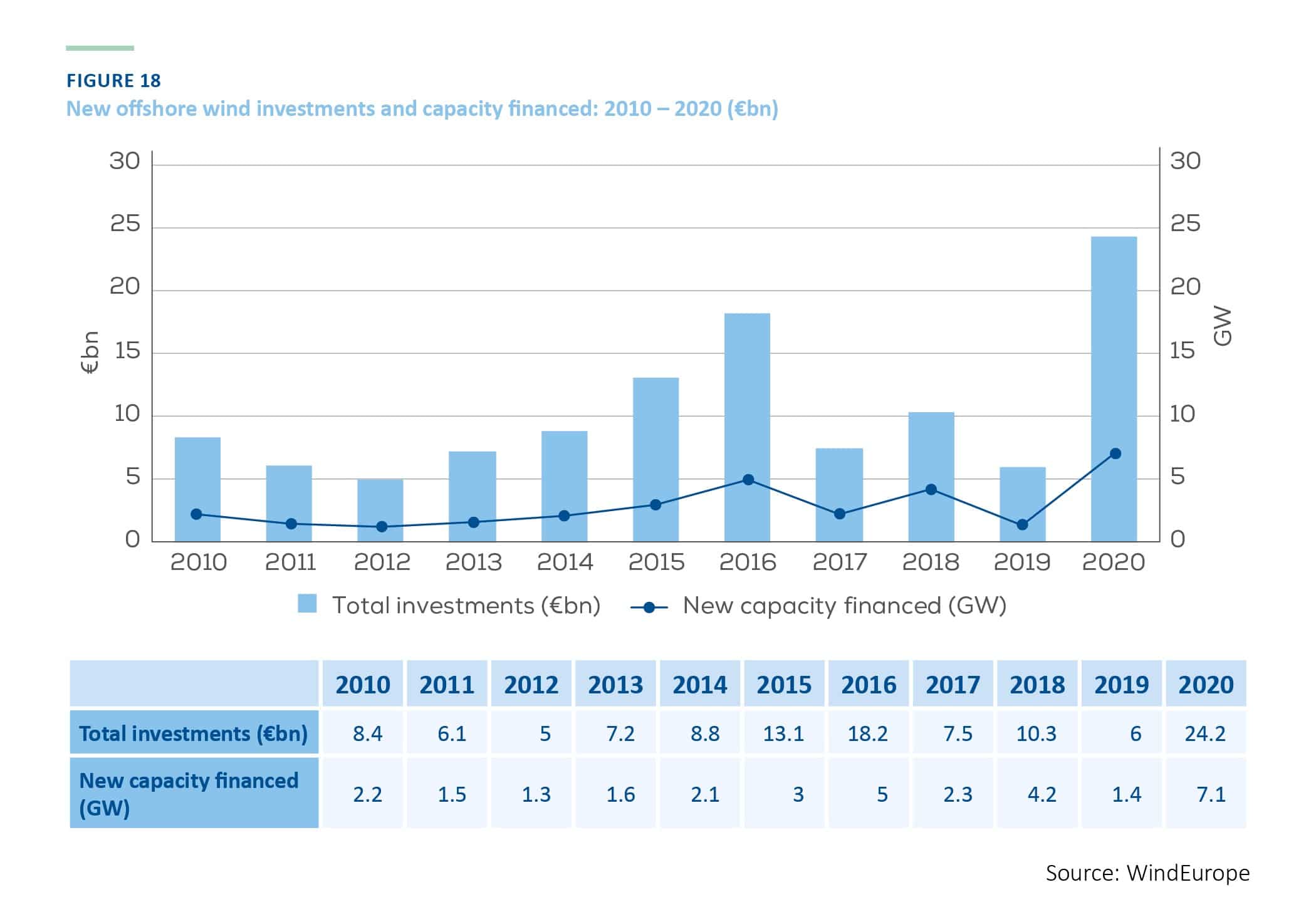

- Eight new offshore wind projects have reached Final Investment Decision (FID) in four different countries in 2020, with construction expected to start in the coming years. Investments in new assets represented 26.3 billion euros to finance 7.1 GW of additional capacity.

2,9 GW ADDED in 2020.

- Netherlands: 1 493 MW

- Belgium: 706 MW

- UK: 483 MW

- Germany: 219 MW

- Portugal: 17 MW

25 GW installed capacity in Europe

5 countries represent 99% this installed capacity:

- UK is first with 42%

- Germany second with 31%,

- then Netherlands is 3rd with 10%, followed by Belgium (9%) et and Denmark (7%).

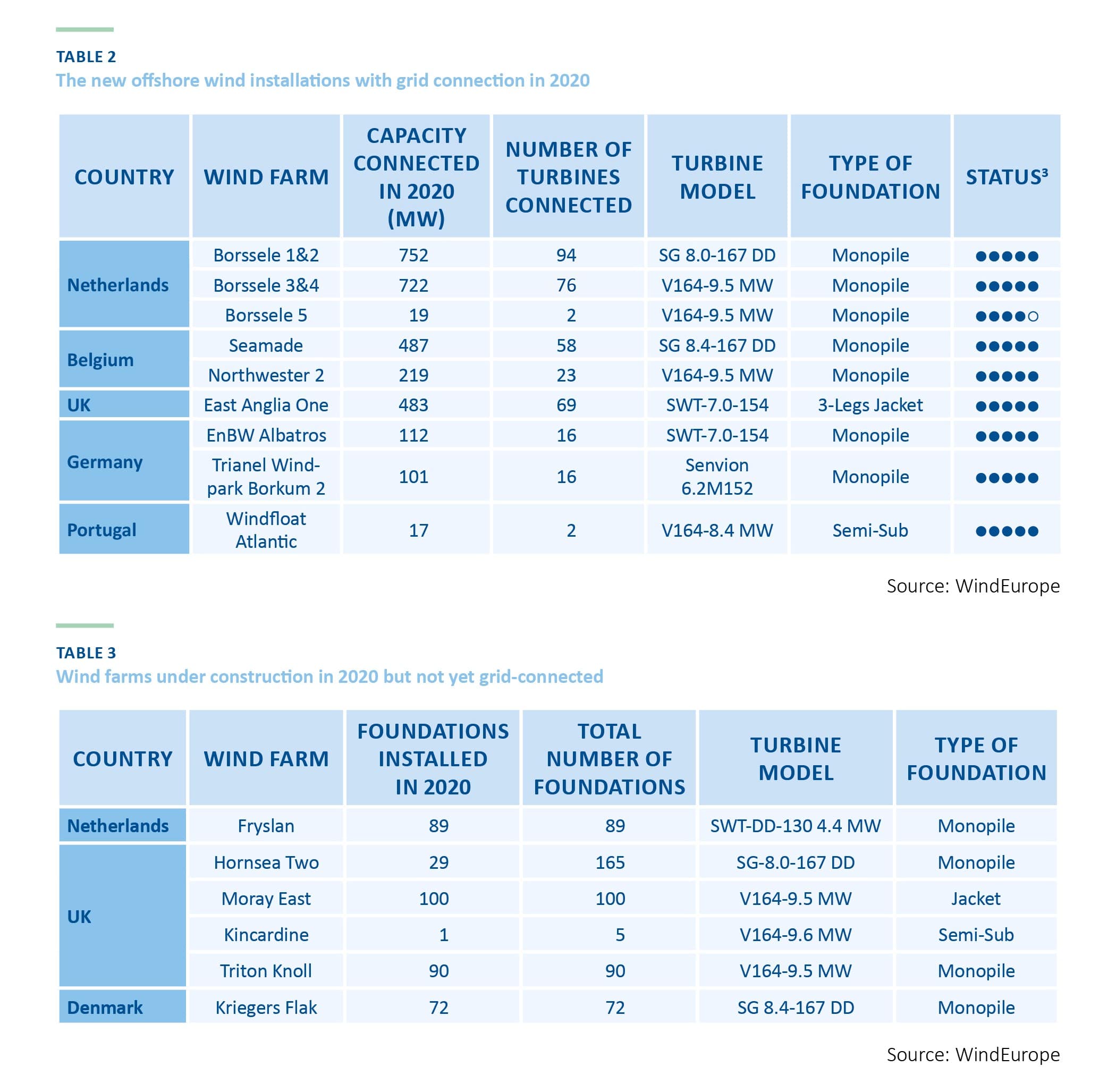

16 offshore wind farms in 6 countries

- Nine wind farms connected turbines to the grid in 2020

- Six wind farms installed foundations but did not connect any turbine to the grid.

- Last year, all installations took place in the North Sea except for Windfloat Atlantic which connected two floating turbines in the Atlantic Ocean.

Record investments of 26,3 Billions euros

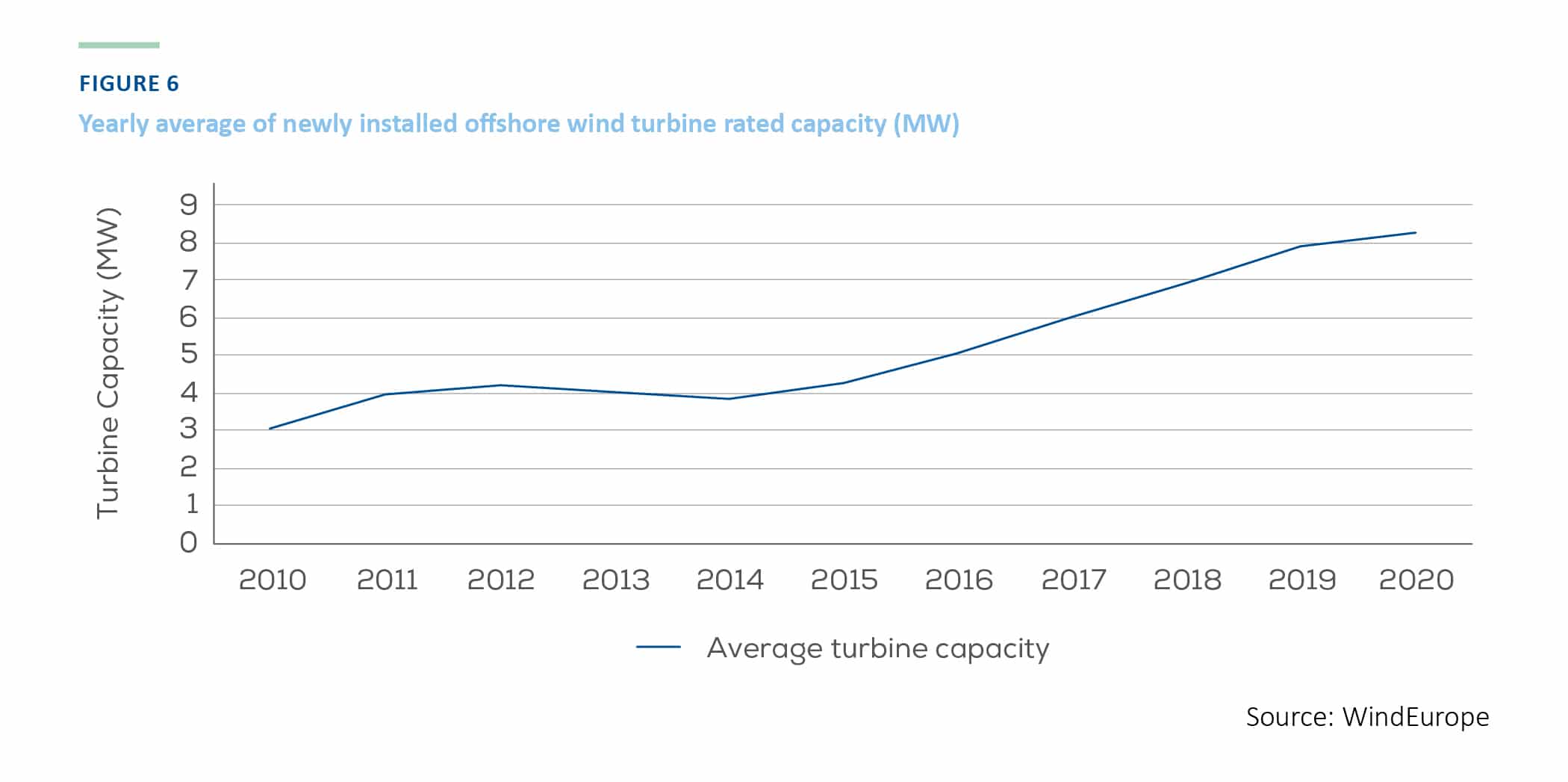

Mean Wind turbine rated capacityof 8,2 MW.

Turbines continue to grow and the average nominal power of turbines installed in 2020 has risen to 8.2 MW, 2/3 of which with higher power:

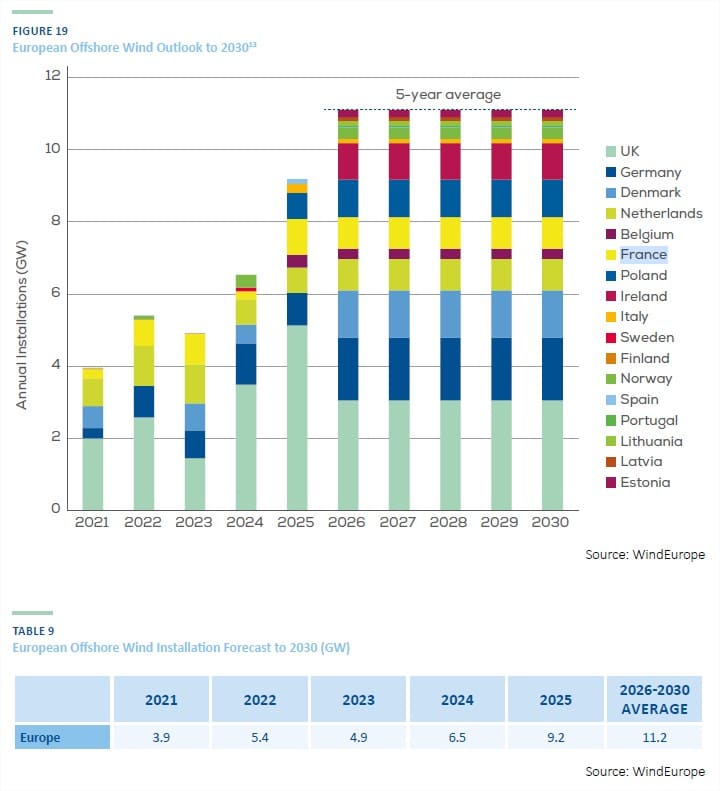

OUTLOOK for 2030 EUROPEAN OFFSHORE WIND

- In total, government deployment commitments in Europe will add up to 111 GW of offshore wind by 2030.

- To meet these volumes, Europe will have to move from the current installation rate of 3 GW / year to 11 GW / year in 2026 and maintain this annual deployment until 2030.

- France could see its first commercial farm installations as early as 2021 and then follow a rhythm of regular deployment.

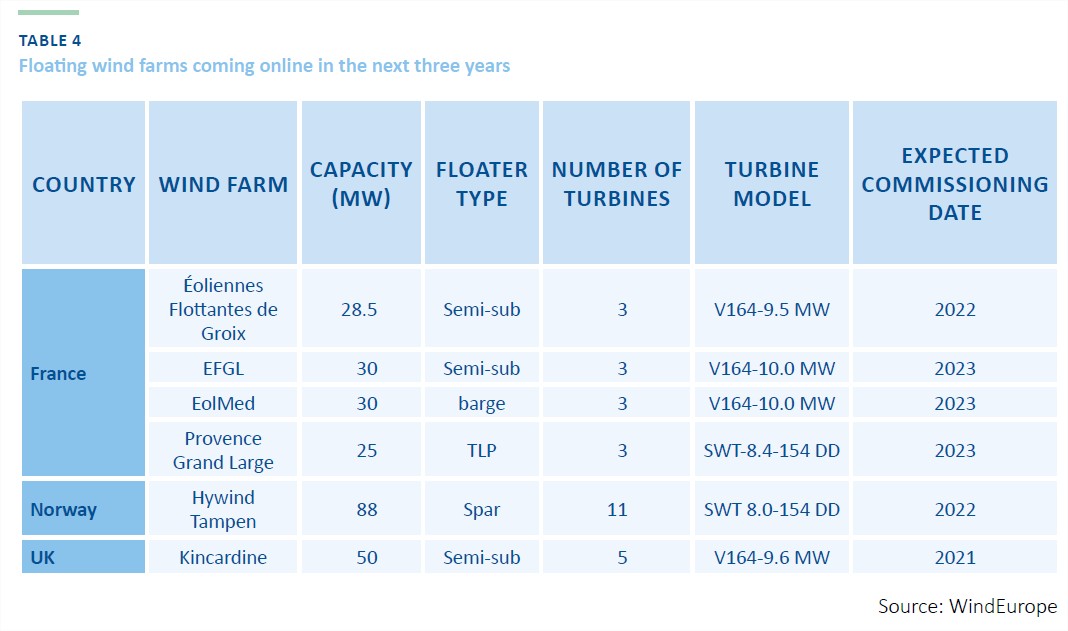

Floating Wind

- The deployed floating wind power in Europe totaled 62 MW at the end of 2020.

- This now represents 83% of the world’s floating wind capacity.

- 2020 saw the commissioning of Windfloat Atlantic (25 MW) in Portugal.

- Kincardine (50 MW) is currently under construction off Aberdeen, and once operational it will become the largest project with five V164-9.5 MW turbines followed by Hywind Tampen (88 MW) who made the decision to financial investment in 2019 and is in the pre-construction phase.

- The European pipeline of floating projects for the next decade is over 7 GW. France, Norway and the UK are the most ambitious.

- France is a pioneer with the current development of 4 pre-commercial farms and will launch 3 commercial calls for tenders of 250 MW from 2021. It is followed by Norway which will open two zones (4.5 GW in total) for development in 2021, including one adapted to floating. Scotland and the largest offshore wind development area ScotWind are also awaiting applications for floating projects as the water depths are deep.